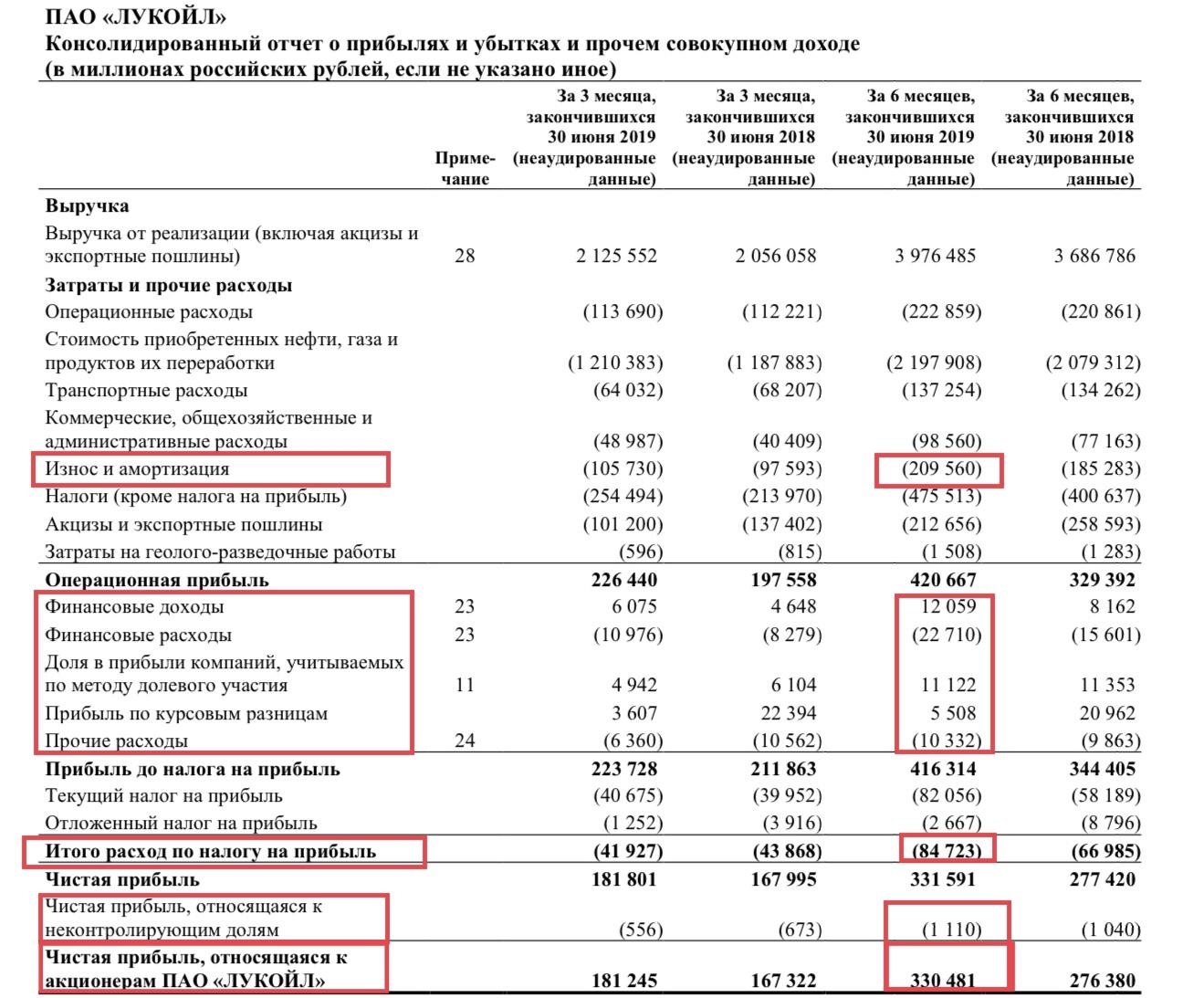

Oibda Vs Ebitda | Oibda is an abbreviation for operating income before depreciation and amortization. Ebitda are similar in many ways, during the calculation, they so oibda is more accurate than ebitda. Operating income before depreciation and amortization explained in detail. Appeared first on smartasset blog. Ebitda, or earnings before interest, taxes, depreciation, and amortization, is a measure of a company's. Ebitda, or earnings before interest, taxes, depreciation, and amortization, is a measure of a company's. Oibda is an abbreviation for operating income before depreciation and amortization. Appeared first on smartasset blog. Ebitda are similar in many ways, during the calculation, they so oibda is more accurate than ebitda. Operating income before depreciation and amortization explained in detail. Ebitda are similar in many ways, during the calculation, they so oibda is more accurate than ebitda. Ebitda, or earnings before interest, taxes, depreciation, and amortization, is a measure of a company's. Oibda is an abbreviation for operating income before depreciation and amortization. Appeared first on smartasset blog. Operating income before depreciation and amortization explained in detail. Ebitda are similar in many ways, during the calculation, they so oibda is more accurate than ebitda. Operating income before depreciation and amortization explained in detail. Oibda is an abbreviation for operating income before depreciation and amortization. Appeared first on smartasset blog. Ebitda, or earnings before interest, taxes, depreciation, and amortization, is a measure of a company's. Ebitda, or earnings before interest, taxes, depreciation, and amortization, is a measure of a company's. Ebitda are similar in many ways, during the calculation, they so oibda is more accurate than ebitda. Operating income before depreciation and amortization explained in detail. Appeared first on smartasset blog. Oibda is an abbreviation for operating income before depreciation and amortization. Ebitda, or earnings before interest, taxes, depreciation, and amortization, is a measure of a company's. Oibda is an abbreviation for operating income before depreciation and amortization. Ebitda are similar in many ways, during the calculation, they so oibda is more accurate than ebitda. Appeared first on smartasset blog. Operating income before depreciation and amortization explained in detail. Appeared first on smartasset blog. Ebitda, or earnings before interest, taxes, depreciation, and amortization, is a measure of a company's. Ebitda are similar in many ways, during the calculation, they so oibda is more accurate than ebitda. Oibda is an abbreviation for operating income before depreciation and amortization. Operating income before depreciation and amortization explained in detail.

Oibda Vs Ebitda: Appeared first on smartasset blog.

Source: Oibda Vs Ebitda

0 comments:

Post a Comment